How to Calculate Interest on a Loan: Smart Tips

To calculate interest on a loan, multiply the loan amount by the annual interest rate, then divide the result by the number of payments per year. For a more accurate calculation, take into account the loan term, compounding periods, and any additional fees or charges.

Calculating interest on a loan is essential for determining the total cost of borrowing and making informed financial decisions. Whether you’re taking out a mortgage, personal loan, or car loan, you must know how to calculate interest on a loan. Interest rates can vary depending on the lender, loan amount, credit score, and other factors.

By calculating the interest on a loan, you can determine the monthly payments and total amount of interest paid over the loan term. This information can help you compare loan options and choose the best one for your needs.

Introduction To Interest Calculations

Understanding how interest is calculated on a loan is essential for anyone considering borrowing money. Whether you’re taking out a mortgage, a car loan, or a personal loan, having a grasp of interest calculations can help you make informed financial decisions and avoid unnecessary costs.

The Importance Of Knowing Your Numbers

Knowing how to calculate the interest on a loan is crucial for managing your finances effectively. It allows you to determine the total cost of borrowing and assess whether a loan is affordable for you. By understanding the interest calculations, you can compare different loan options and choose the most cost-effective solution.

Types Of Interest: Simple Vs. Compound

There are two primary types of interest: simple and compound. Simple interest is calculated only on the initial loan amount, while compound interest takes into account both the principal amount and the accumulated interest. Understanding the difference between these two types of interest can help you make informed decisions about the best loan option for your specific needs.

:max_bytes(150000):strip_icc()/calculate-loan-interest-315532-Final-5c58592346e0fb000164daf0.png)

Credit: www.thebalancemoney.com

Determining The Loan Amount

To determine the loan amount, calculate the interest using the principal amount, interest rate, and loan term. By multiplying these factors, you can find the total interest payable over the loan period. This calculation helps in understanding the overall cost of borrowing.

Assessing Your Borrowing Needs

Before determining the loan amount, it is crucial to assess your borrowing needs. Start by evaluating the purpose of the loan and the specific expenses you need to cover. Are you looking to buy a new car, pay for home renovations, or fund your education?

Factoring In Additional Fees

While determining the loan amount, it is important to factor in any additional fees associated with the borrowing process. These fees can include origination fees, processing fees, or other charges that lenders may impose. By considering these fees upfront, you can ensure that your loan amount covers not only the desired funds but also these additional costs.

Calculating the loan amount involves a few simple steps. Firstly, you need to determine the total amount you need, including the borrowing needs and the additional fees. For example, if you need $10,000 for a car purchase and the lender charges a $500 origination fee, your total borrowing amount would be $10,500.

Next, you should consider any down payment or collateral you plan to provide. If you have savings that you can use as a down payment or an asset that can serve as collateral, it can significantly impact the loan amount. For instance, if you plan to provide a $2,000 down payment, you would only need to borrow $8,500.

Another factor to consider is the interest rate. The interest on a loan is the cost of borrowing money, and it is usually expressed as an annual percentage rate (APR). Higher interest rates can result in higher monthly payments and overall loan costs. Therefore, it is essential to compare interest rates from different lenders and choose the most favorable option.

Understanding Interest Rates

Interest rates play a crucial role in determining the overall cost of a loan.

Fixed Rates Vs. Variable Rates

Fixed rates remain constant throughout the loan term.

Variable rates can fluctuate based on market conditions.

How Rates Affect Loan Cost

- Higher rates lead to increased total repayment amount.

- Lower rates result in reduced overall borrowing expenses.

:max_bytes(150000):strip_icc()/how-to-calculate-student-loan-interest-4772208_final-39fc8391e4e2462e91d1632c7f8abe72.png)

Credit: www.investopedia.com

Interest Calculation Basics

Calculating interest on a loan involves multiplying the principal amount by the interest rate and the time period. The formula is Principal x Rate x Time = Interest. By understanding these basics, you can manage your finances better and make informed borrowing decisions.

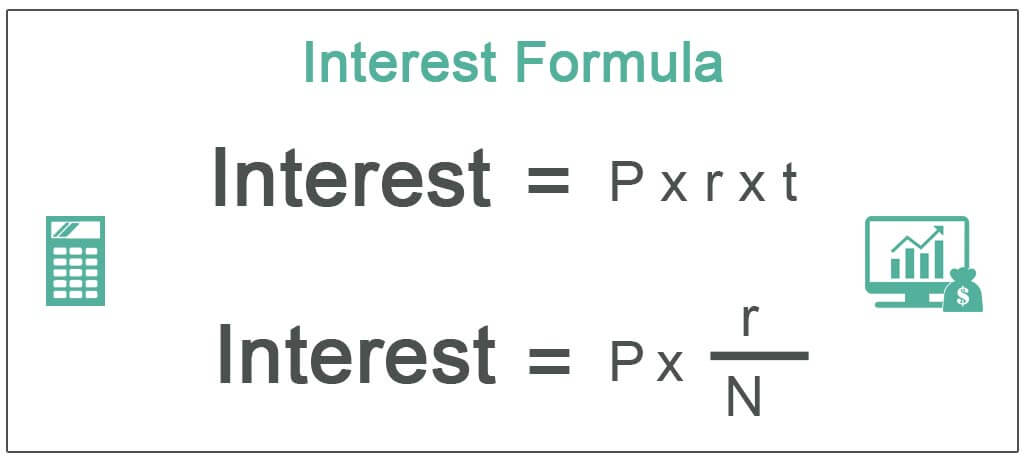

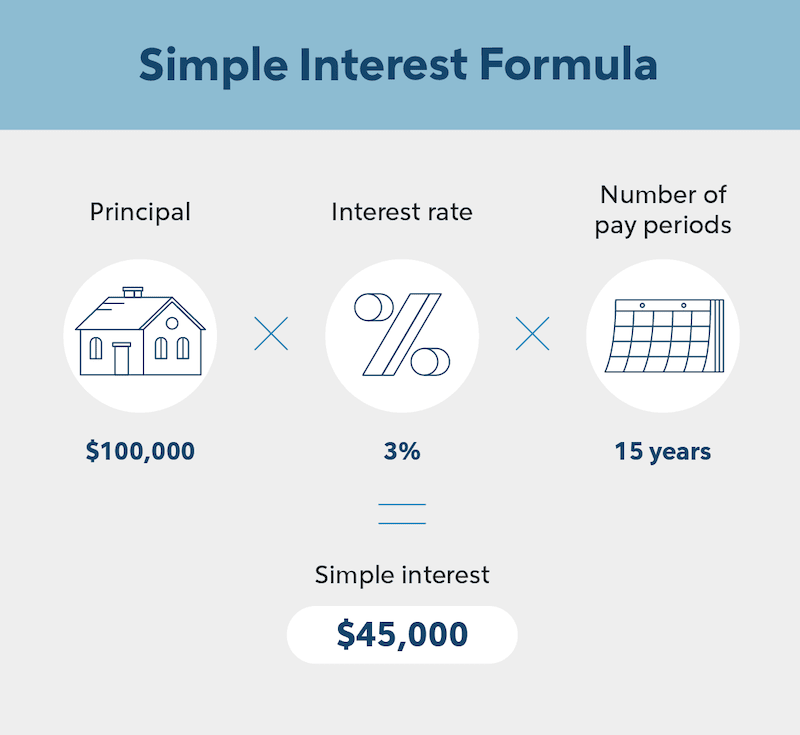

The Formula For Simple Interest

To understand how to calculate interest on a loan, it’s essential to grasp the concept of simple interest. Simple interest is calculated using a straightforward formula:

Interest = Principal x Rate x Time

- Principal: The initial amount of money borrowed or invested.

- Rate: The percentage of interest charged or earned per time period.

- Time: The duration for which the money is borrowed or invested.

For example, let’s say you borrow $1,000 from a lender at an annual interest rate of 5% for a period of 2 years. Using the formula, the calculation would be:

Interest = $1,000 x 0.05 x 2 = $100

In this case, you would pay $100 in interest over the 2-year period.

Calculating Compound Interest

While simple interest is relatively straightforward, compound interest adds an additional layer of complexity. With compound interest, the interest is calculated not only on the initial principal but also on any accumulated interest from previous periods.

The formula for calculating compound interest is as follows:

A = P(1 + r/n)^(nt)

- A: The future value of the investment or loan, including interest.

- P: The principal amount.

- r: The annual interest rate (expressed as a decimal).

- n: The number of times that interest is compounded per year.

- t: The number of years the money is invested or borrowed.

To better understand compound interest, let’s consider an example. Suppose you invest $1,000 in a savings account with an annual interest rate of 5%, compounded annually, for a period of 3 years. Using the formula, the calculation would be:

A = $1,000(1 + 0.05/1)^(1 3) = $1,157.63

In this case, your investment would grow to $1,157.63 over the 3-year period, with $157.63 being the interest earned.

Tricks To Pay Off Loans Faster

Struggling to pay off your loan quickly? Check out these expert strategies to accelerate your repayment process.

Snowball Vs. Avalanche Methods

Snowball Method: Start by paying off the smallest debt first, then move on to larger debts.

Avalanche Method: Focus on the debt with the highest interest rate to save money in the long run.

Refinancing Options

Consider refinancing your loan to secure a lower interest rate and reduce your monthly payments.

Avoiding Common Mistakes

Calculating interest on a loan can be a complex task, but avoiding common mistakes can make it easier. To accurately calculate interest, ensure that you have the correct loan amount, interest rate, and loan term. Additionally, be sure to use the correct formula and double-check your calculations for accuracy.

Not Reading The Fine Print

Failure to read the fine print can lead to unexpected fees and terms.

Ignoring Loan Amortization

Understanding loan amortization helps in managing payments effectively.

Credit: www.quickenloans.com

Frequently Asked Questions

What Is The Formula To Calculate Interest On A Loan?

To calculate interest on a loan, use the formula: Interest = Principal x Rate x Time. The principal is the amount borrowed, the rate is the annual interest rate, and the time is the duration of the loan in years.

Multiply these values together to find the total interest payable.

What Is 6% Interest On A $30,000 Loan?

The 6% interest on a $30,000 loan amounts to $1,800 per year.

How Do You Calculate Interest On A Loan Account?

To calculate interest on a loan account, multiply the loan amount by the interest rate, and then multiply that result by the loan term. Finally, divide the total by the number of months in a year. For example, if you have a $10,000 loan with a 5% interest rate for 2 years, the interest calculation would be: ($10,000 x 0.

05 x 2) / 12 = $833. 33.

How Do I Calculate Interest Per Month?

To calculate interest per month, use the formula: Interest = Principal amount × Rate of interest × Time period (in months) / 100.

Conclusion

Understanding how to calculate interest on a loan is essential for making informed financial decisions. By following the simple steps outlined in this blog post, you can accurately determine the amount of interest you will pay over the life of the loan.

Remember to consider factors such as the interest rate, loan term, and compounding frequency. Armed with this knowledge, you can confidently navigate the world of loans and ensure that you are getting the best deal possible.