How to Calculate Mortgage Payments: Free Mortgage Calculator

Mortgage Payment Calculator

Enter your loan details to calculate your monthly mortgage payment.

Understanding how to calculate mortgage payments is crucial for anyone planning to buy a home, refinance, or manage their budget. This guide will break down the process, explain key terms like mortgage rates and loan terms, and introduce free tools like a mortgage payment calculator to simplify the math.

What is a Mortgage Payment?

A mortgage payment typically includes four components (often abbreviated as PITI):

- Principal: The amount borrowed to buy the home.

- Interest: The cost of borrowing the money, determined by your mortgage rate.

- Taxes: Property taxes paid to your local government.

- Insurance: Homeowner’s insurance and, if applicable, private mortgage insurance (PMI).

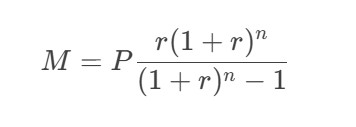

The Mortgage Payment Formula

The most common formula to calculate your monthly mortgage payment is:

Where:

- MM = Monthly mortgage payment

- PP = Loan principal (amount borrowed)

- rr = Monthly interest rate (annual rate ÷ 12)

- nn = Total number of payments (loan term in years × 12)

Step-by-Step: How to Calculate Mortgage Payments

Example:

Let’s calculate the monthly payment for a $300,000 loan at a 4% annual interest rate over 30 years.

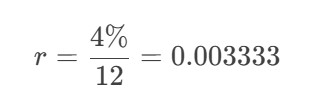

- Convert the annual rate to a monthly rate:

2. Calculate the total number of payments: n = 30×12=360

3. Plug into the formula:

4. Result: M ≈ $1,432.25 per month

This amount doesn’t include taxes, insurance, or PMI. Use a free mortgage calculator like Zillow’s or Bankrate’s to factor in these costs.

Factors Affecting Your Mortgage Payment

- Loan Amount: A higher principal increases payments.

- Interest Rate: Lower rates reduce monthly costs. Check mortgage rates today for current averages.

- Loan Term: A 15-year term has higher monthly payments but less interest than a 30-year term.

- Down Payment: A larger down payment reduces the principal.

- Credit Score: Higher scores qualify for better mortgage rates.

Types of Mortgage Calculators

- Basic Mortgage Calculator:

- Estimates principal + interest (e.g., measuretutor.com’s mortgage calculator).

- Advanced Mortgage Calculator:

- Includes taxes, insurance, and PMI (e.g., Zillow Mortgage Calculator).

- Refinance Calculator:

- Compares current and new loan terms.

- Mortgage Calculator by Payment Amount:

- Determines how much house you can afford based on your budget.

How to Use a Free Mortgage Payment Calculator

- Enter Loan Details:

- Principal, interest rate, and term.

- Add Extra Costs:

- Property taxes, insurance, HOA fees.

- Adjust Scenarios:

- See how a larger down payment or shorter term affects payments.

Popular Tools:

- Zillow Mortgage Calculator

- Bankrate Loan Calculator

- PHH Mortgage Payment Estimator

Real-World Example

Scenario:

- Home Price: $450,000

- Down Payment: 20% ($90,000)

- Loan Amount: $360,000

- Interest Rate: 3.5%

- Term: 30 years

- Property Taxes: $3,000/year

- Insurance: $1,200/year

Calculation with a Mortgage Payment Estimator:

- Principal + Interest: $1,617

- Taxes + Insurance: $350

- Total Monthly Payment: $1,967

Tips to Lower Your Mortgage Payment

- Improve Your Credit Score: Qualify for lower mortgage interest rates.

- Choose a Longer Term: A 30-year loan has lower payments than a 15-year loan.

- Make a Larger Down Payment: Reduces the principal and eliminates PMI.

- Refinance: Secure a lower rate if market rates drop.

Common Mortgage FAQs

Q: What is PMI?

A: Private Mortgage Insurance is required if your down payment is less than 20%. It adds 30–30–70 per month per $100,000 borrowed.

Q: How do adjustable-rate mortgages (ARMs) work?

A: ARMs have lower initial rates that adjust annually after a fixed period (e.g., 5/1 ARM). Use a mortgage rate calculator to compare ARM vs. fixed-rate costs.

Q: How accurate are online mortgage calculators?

A: Tools like the Bankrate Loan Calculator or Zillow Mortgage Calculator provide estimates. For exact figures, consult a lender.

Why Use a Mortgage Calculator?

- Budgeting: Determine what you can afford.

- Comparison: Compare loan offers or refinancing options.

- Transparency: Avoid surprises by factoring in all costs.

Conclusion

Learning how to calculate mortgage payments empowers you to make informed decisions when buying a home or refinancing. Use free mortgage calculator tools to experiment with different scenarios, and always factor in taxes, insurance, and loan terms. Whether you’re a first-time buyer or a seasoned homeowner, understanding these calculations ensures you stay financially prepared.