How to Calculate Tax from Total Amount: Quick & Easy Guide

To calculate tax from total amount, multiply the total amount by the tax rate as a decimal. For example, if the tax rate is 10% and the total amount is $100, then the tax amount would be $10 (10% of $100).

Calculating tax from the total amount is an essential skill for anyone who deals with finances. Whether you’re self-employed or work for a company, understanding how to calculate tax is crucial to managing your finances effectively. Taxes are a percentage of your income that must be paid to the government, and failure to do so can result in penalties.

Tax rates vary depending on your income level and other factors, so it’s essential to understand the tax laws in your country. In this blog post, we’ll cover everything you need to know about calculating tax from the total amount, including tips and examples to help simplify the process.

Credit: www.youtube.com

Introduction To Tax Calculations

When it comes to managing personal or business finances, understanding how to calculate tax from the total amount is essential. Whether you’re an individual taxpayer or a business owner, having a grasp of tax calculations can help you make informed financial decisions and ensure compliance with tax laws. In this section, we’ll explore the basics of tax calculations, including why it’s essential to know how to calculate tax, basic tax terminology, and practical examples to illustrate the process.

Why Knowing Tax Calculation Is Essential

Understanding tax calculation is crucial for individuals and businesses to accurately determine their tax liabilities. It enables informed financial planning and compliance with tax laws, avoiding potential penalties and legal issues.

Basic Tax Terminology

Before delving into tax calculations, it’s important to familiarize ourselves with some basic tax terminology. Below are key terms that form the foundation of tax calculations:

- Gross Income

- Taxable Income

- Tax Deductions

- Tax Credits

Credit: study.com

Understanding The Total Amount

Before diving into calculating tax from the total amount, it’s important to have a clear understanding of what the total amount represents. The total amount is the sum of all the components that make up a particular transaction or financial calculation.

Components Of The Total Amount

The total amount consists of various components that contribute to the overall value. These components may include:

- Product or service cost

- Shipping or handling fees

- Discounts or promotions

- Additional charges or surcharges

Each of these components contributes to the final total amount, and it’s essential to consider them when calculating tax.

Distinguishing Between Gross And Net

When dealing with the total amount, it’s important to understand the difference between gross and net values. The gross amount refers to the total value before any deductions or taxes are applied, while the net amount represents the final value after deducting taxes and other applicable deductions.

Understanding whether you are working with the gross or net amount is crucial for accurate tax calculations. It ensures that you are considering the appropriate base value when determining the tax to be applied.

In summary, the total amount is the sum of all the components involved in a financial transaction. It is important to distinguish between gross and net values to accurately calculate tax. By understanding these key concepts, you can navigate tax calculations with confidence and ensure accurate financial planning.

Different Types Of Taxes

Calculating tax from the total amount involves understanding different types of taxes such as income, sales, property, and capital gains. Each tax type has its own calculation method based on rates and taxable amounts, making it crucial to accurately compute the total tax liability.

Sales Tax Basics

Different types of taxes play a crucial role in our economy.Income Tax: An Overview

1. Sales Tax – Applied to goods and services at the point of sale. 2. Income Tax – Tax on earnings from employment or investments. 3. Property Tax – Levied on the value of real estate owned. 4. Capital Gains Tax – Tax on profits from the sale of assets. 5. Corporate Tax – Imposed on a company’s profits.Step-by-step Tax Calculation

Calculating taxes can sometimes be a daunting task, especially if you’re not familiar with the process. However, by following a few simple steps, you can easily calculate the tax from the total amount. In this guide, we will walk you through the process step-by-step, making it easier for you to determine the tax amount accurately.

Identifying The Tax Rate

The first step in calculating tax from the total amount is to identify the applicable tax rate. The tax rate can vary depending on your location and the type of goods or services you’re dealing with. To find the tax rate, you can refer to your local tax regulations or check the official government website. Once you have identified the tax rate, you are ready to move on to the next step.

Applying The Tax Rate To Your Amount

Now that you have the tax rate, it’s time to apply it to your total amount. To calculate the tax, you need to multiply the total amount by the tax rate expressed as a decimal. For example, if the tax rate is 10%, you would multiply the total amount by 0.10. The result will be the tax amount that needs to be added to the total.

Let’s take an example to illustrate this. Suppose you have a total amount of $100 and the tax rate is 8%. To calculate the tax amount, you would multiply $100 by 0.08, which gives you $8. This means that the tax amount for this particular transaction would be $8.

Once you have calculated the tax amount, you can simply add it to the total amount to get the final amount including tax. In our example, the final amount would be $100 + $8 = $108.

It’s important to note that tax calculations may involve additional factors such as exemptions, deductions, or different tax rates for specific items. Therefore, it’s always a good idea to consult with a tax professional or refer to your local tax laws for more accurate calculations.

By following these simple steps, you can easily calculate tax from the total amount. Remember to always double-check your calculations and seek professional advice if needed. Understanding how taxes are calculated will not only help you stay compliant with tax regulations but also empower you to make informed financial decisions.

Using Online Calculators

Calculating taxes can be a daunting task, especially if you’re not familiar with the tax laws and regulations. Fortunately, online tax calculators have made this process much easier and more efficient. In this post, we will discuss how you can use online calculators to calculate taxes from the total amount.

Popular Tax Calculator Tools

There are several tax calculators available online, and each has its own unique features. Here are some of the most popular tax calculator tools:

| Tax Calculator | Features |

|---|---|

| TurboTax | Offers both free and paid versions. Provides detailed tax guidance. |

| H&R Block | Offers free tax calculator tool. Can import tax information from previous years. |

| TaxAct | Offers free tax calculator tool. Provides access to tax professionals for additional help. |

Accuracy And Reliability Of Online Calculators

While online tax calculators are a convenient way to calculate taxes, it’s important to remember that they are not always 100% accurate. It’s crucial to double-check the calculations and make sure that all the information entered is correct.

Additionally, not all online tax calculators are reliable. Some may not take into account all the tax deductions and credits that you’re eligible for, which could result in an inaccurate calculation. Therefore, it’s recommended to use tax calculators from reputable sources and cross-check the results with other calculators or professional tax advisors.

Overall, using online tax calculators can make the tax calculation process much simpler and faster. Just make sure to double-check the calculations and use reputable calculators to ensure the accuracy and reliability of the results.

Tax Calculation Examples

Tax calculation examples provide a clear understanding of how to calculate tax from the total amount. By examining specific scenarios, individuals and businesses can gain insight into the process and ensure accurate tax calculations.

Example For Personal Purchase

When calculating tax for a personal purchase, such as buying a product from a store, the process is straightforward. Let’s say the total amount of the purchase is $100 and the tax rate is 8%. To calculate the tax amount:

- Multiply the total amount by the tax rate: $100 x 8% = $8.

- The tax amount is $8, which is added to the total amount: $100 + $8 = $108.

Business Tax Calculation Scenario

For businesses, the tax calculation process can be more complex, especially when dealing with multiple transactions and varying tax rates. Let’s consider a scenario where a business has made several sales with different tax rates:

| Sale | Total Amount | Tax Rate | Tax Amount |

|---|---|---|---|

| Sale 1 | $500 | 10% | $50 |

| Sale 2 | $800 | 8% | $64 |

| Sale 3 | $300 | 6% | $18 |

Total tax amount for all sales: $50 + $64 + $18 = $132.

Common Mistakes To Avoid

Avoid common mistakes when calculating tax from the total amount. Double-check figures, consider deductions, and stay updated on tax laws to prevent errors. Be meticulous with calculations to ensure accuracy and compliance with regulations.

Misinterpreting Tax Rates

Misunderstanding tax rates can lead to errors in calculations.

Double-check current tax rates before making calculations.

Forgetting To Update Tax Tables

Neglecting to update tax tables can result in inaccurate figures.

Regularly check and update tax tables to ensure accuracy.

Faqs In Tax Calculation

Looking to calculate tax from the total amount? Follow these FAQs in tax calculation for a clear understanding. Simply multiply the total amount by the tax rate to find the tax due. Remember to subtract any deductions before applying the tax rate.

Addressing Frequent Concerns

When it comes to calculating tax from the total amount, there are several common questions that often arise. Let’s address some of the most frequently asked questions to help you navigate through the process smoothly.

Expert Tips For Efficient Calculation

- Always double-check your math calculations.

- Use online tax calculators for accuracy.

- Keep detailed records of your expenses.

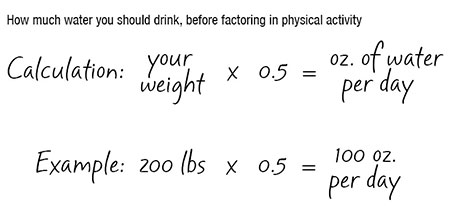

Q: How do I calculate tax from the total amount?

A: To calculate tax from the total amount, multiply the total by the tax rate.

Q: What is the formula for calculating tax?

A: The formula is Total Amount x Tax Rate = Tax Amount.

Q: Can I deduct expenses before calculating tax?

A: Yes, deduct allowable expenses before calculating tax for accurate results.

| Question | Answer |

|---|---|

| How do I calculate tax? | Multiply total by tax rate. |

| Is there a formula for tax calculation? | Total Amount x Tax Rate = Tax Amount. |

| Should expenses be deducted before tax calculation? | Yes, deduct allowable expenses for accuracy. |

Credit: www.calculatorsoup.com

Frequently Asked Questions

How Do You Calculate Tax From Total?

To calculate tax from total, multiply the total amount by the tax rate. For example, if the tax rate is 10% and the total amount is $100, the tax amount will be $10 ($100 x 0. 10).

How Do You Calculate Sales Tax Backwards From A Total?

To calculate sales tax backwards from a total, divide the total by 1 plus the sales tax rate. Then, subtract the original amount from the result to find the sales tax amount.

How Do I Calculate Tax On My Calculator?

To calculate tax on your calculator, multiply the total amount by the tax rate percentage. For example, $100 with a 5% tax rate would be $100 x 0. 05 = $5 tax.

How Do You Calculate Total Tax Revenue?

Total tax revenue is calculated by summing up all the taxes collected by the government. This includes income tax, sales tax, property tax, and other forms of taxation. The government uses this revenue to fund public services and programs.

Conclusion

Calculating tax from the total amount is a crucial task that requires accuracy and attention to detail. By following the steps outlined in this blog post, you can ensure that you accurately calculate the tax owed. Remember to consider the applicable tax rate, apply it to the total amount, and round the final result if necessary.

This knowledge will empower you to handle your tax obligations with confidence and ease. Start calculating taxes with precision today!